Main Content

-

Count On Us

Information about Medicare and related Issues can be found here on our site, in our CMA Alert, and through our CMA webinars.

-

Real Medicare Matters

The Medicare program must be implemented in a manner that provides better coverage and cost-sharing protections for ALL beneficiaries, not just those in wasteful private plans.

-

Our Commitment to Justice

For over 35 years, the mission of the Center has been to ensure fair access to Medicare and health care for all. FAIR. FOR ALL. We can’t separate ourselves from the greater fight for fairness, for justice – for all.

Highlights

Free Webinars

Enjoy free live and recorded online education sessions on Medicare topics from basic enrollment to detailed coverage issues.

Up Next - Practical Tips for Getting and Keeping Medicare-Covered Care

Wednesday, May 15, 2024 from 2:00 - 3:00 EST

Join us to Refresh your knowledge of Medicare-covered services and equipment, hear about typical access problems, learn “Do’s & Don’ts” to maximize coverage and minimize delays, and understand appeal basics.

Register and Explore our library now.

Discover the Impact of CMA

Check out the Center's

Annual Report.

National Medicare Advocates Alliance

The Center for Medicare Advocacy's National Medicare Advocates Alliance provides Medicare advocates with a collaborative network to share resources, best practices, and developments of import to Medicare beneficiaries throughout the country. The Alliance is supported by the John A. Hartford Foundation.

2024 Medicare Handbook Now Available

News

Know Jimmo | New CMS Implementation Activity

The Center for Medicare Advocacy is delighted to report that on February 13, 2024, CMS issued several important reminders to providers and adjudicators in traditional Medicare and Medicare Advantage to refresh and train staff and contractors regarding the erroneous "Improvement Standard."

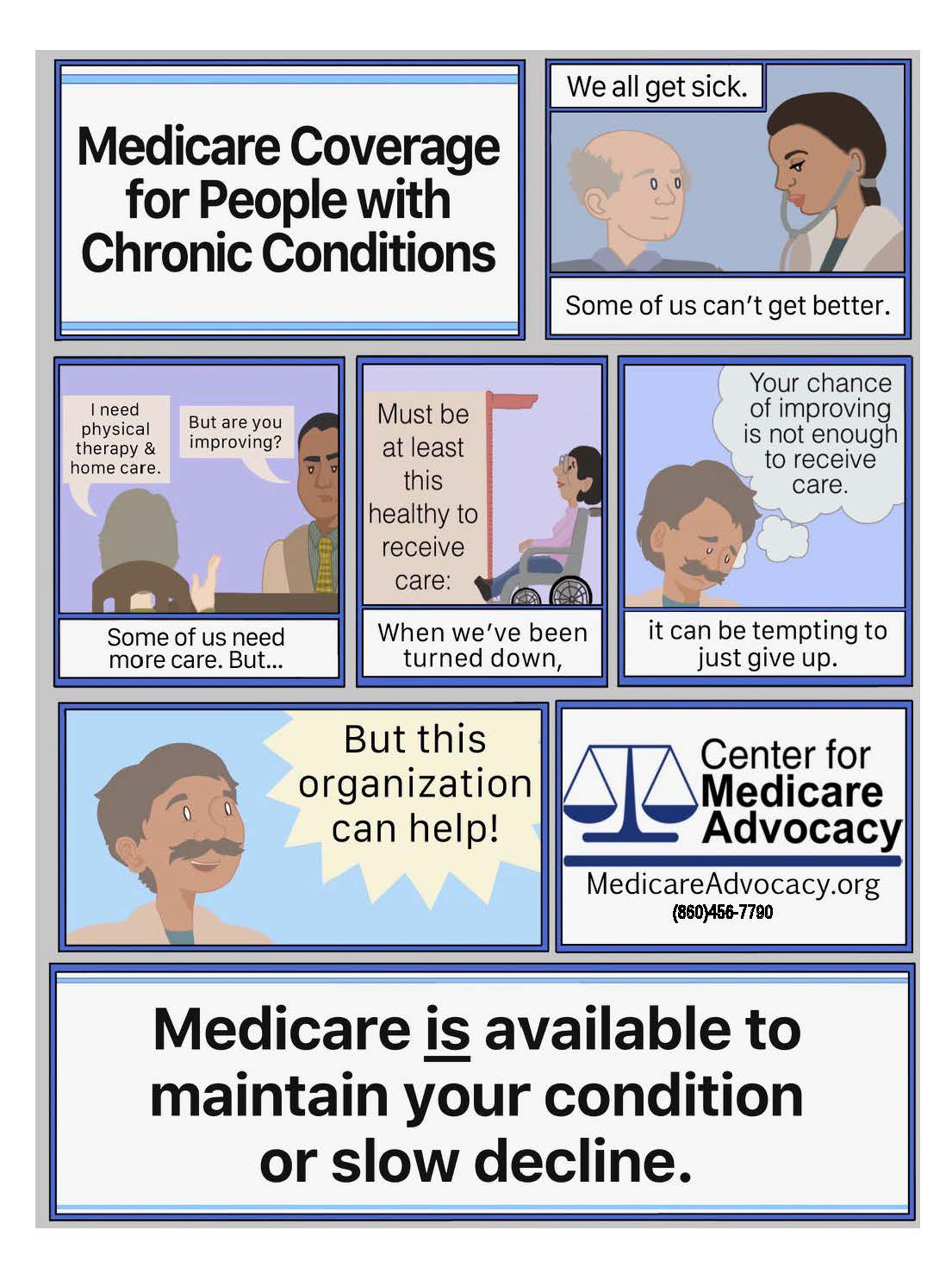

Read more.Chronic Conditions are Coverable - Share this Infographic

Call to Action – Policy Makers Must Increase Medicare Advantage Oversight and Rein in Overpayments

For many years, the Center for Medicare Advocacy has advocated for legislative and administrative efforts to address the growing inequities between Medicare Advantage (MA) and traditional Medicare, that favor MA, and encourage the growing privatization of the Medicare program. These inequities include overpayments to MA plans that unnecessarily drive-up Medicare spending, and lax oversight of MA plans that fails to impose adequate consumer protections.

Read more.Issue Brief:

Retiree Auto-Enrollment in Medicare Advantage Plans – Choice is Under Threat

Automatic enrollment of Medicare-eligible beneficiaries into employer or union-sponsored group MA plans is a concern; among other things, it limits care options for millions of people and erodes the Medicare statute’s protection of choice.

Medicare Home Health Coverage: Reality Conflicts with the Law

Under the law, Medicare coverage is available for people with acute and/or chronic conditions, and for services to improve, or maintain, or slow decline of the individual’s condition, and such coverage is available even if the services are expected to continue over a long period of time. Unfortunately, however, people who legally qualify for Medicare coverage frequently have great difficulty obtaining and affording necessary home care.